Global Peer to Peer Lending (P2P) Market is valued at USD 34.16 Billion in 2018 and expected to reach USD 589.05 Billion by 2025 with a CAGR of 50.2% over the forecast period. Universal advancements in technologies which command the processes connected to money lending majorly driving the Global Peer to Peer (P2P) Market.

Scope of Peer to Peer Lending Market Report–

Peer to peer lending (P2P) is the process of lending money to individuals or businesses via online services that connects/contest lenders with borrowers. P2P offers their services more cheaply other than traditional financial institutes. Therefore, lenders can acquire higher returns as compared to investments and saving products given by banks and other institutions. This money lending process is also known as “crowd-lending”. Mostly peer to peer lending is an unsecured type of personal loan even though the largest amount is lent to businesses. Another type which is a secured loan can sometimes be provided by using grandeur assets like jewelry vintage cars, buildings, fine arts, watches or other business properties. Some of the forms of peer to peer lending are; student loans, commercial and real estate loans, payday loans, secured business loans, leasing and factoring. P2P websites give a shelter from market losses occurred because to non-payments loans by conserving certain funds.

The P2P lending market is segmented on the basis of business model, end-users, application and region & country level. Based upon business model the P2P lending market is segmented into alternate marketplace lending and traditional lending. Based upon end-users, the P2P lending market is segmented into consumer credit loans, small business loans, student loans, real estate loans. Based upon application, the P2P lending market is segmented into individuals and businesses.

The regions covered in this Peer to Peer Lending market report are North America, Europe, Asia-Pacific, Latin America and Africa. On the basis of country level, the market of peer to peer lending is sub divided into U.S., Mexico, Canada, U.K., France, Germany, Italy, China, Japan, India, South East Asia, Middle East Asia (UAE, Saudi Arabia, Egypt) GCC, Africa, etc.

Key Players for Peer to Peer Lending Market Report- Some major key players for peer to peer lending market are LendingClub Corporation, Funding Circle Limited, Daric, RateSetter, Prosper Marketplace, Inc., Zopa Limited, Welendus, MarketInvoice and others.

Peer to Peer lending Market Dynamics– Money lending markets have seen many substantial improvements since last few decades. The money lending system has a high demand from small and medium businesses (SMEs) and consumer credits because of the strict credit policies of banks. This leads the customers to go on the P2P lending platforms which have comparatively faster credit acceptance. According to the statistics provided by the P2P Finance Association (P2PFA), net lending flow to SMEs on P2P lending platform has witnessed remarkable increment with compared to net lending by banks. Also, Blockchain based P2P lending is a technology which eliminates midway in the process of P2P. Therefore, acceptance of blockchain technology in P2P lending will make the whole process clear and authentic for borrowers as well as for lenders. It also provides high returns to the investors than the other investments. This money lending pattern has lower interest rates due to high competition amongst the lenders and the lower origination fees. Thus, all these factors are anticipated to drive the market growth over the forecast period.

However, due to the least availability of new technologies in the developing region the traditional P2P market still exists on large scale with respect to business model and riskless investments are not provided in P2P lending. Also, to get the best chance of funding, borrowers have to give their important and personal details to lenders for impressive plans and this is not healthy for borrowers but is the necessary part of this lending system. So these are the conditions which may hamper the market growth.

Moreover, the growth anticipation in P2P lending market will remains constant due to the factors like rise in interest rate, competition with banks and customer market size. The lending is believed to advance the peak and will smoothen the business operations and provide easy loan options for individuals and to businesses. This can create significant revenue opportunities during the forecast period.

Key Benefits for Peer to Peer (P2P) Lending Market Reports

• Global market report covers in-depth historical and forecast analysis.

• Global market research report provides detail information about Market Introduction, Market Summary, Global market Revenue (Revenue USD), Market Drivers, Market Restraints, Market Opportunities, Competitive Analysis, Regional and Country Level.

• Global market report helps to identify opportunities in market place.

• Global market report covers extensive analysis of emerging trends and competitive landscape.

Global Peer to Peer lending Market Segmentation:-

By Business Model:

• Alternate marketplace lending

• Traditional lending

By End-Users:

• Consumer credit loans

• Small business loans

• Student loans

• Real estate loans

By Application:

• Individuals

• Businesses

By Region

• North America

o U.S.

o Canada

o Mexico

• Europe

o UK

o France

o Germany

o Russia

o Rest of Europe

• Asia-Pacific

o China

o South Korea

o India

o Japan

o Rest of Asia-Pacific

• LAMEA

o Latin America

o Middle East

o Africa

Global Peer to Peer Lending Market Regional Analysis- The Peer to peer lending market is segmented into North America, Europe, Asia-Pacific, Latin America, Middle East and Africa. North America is expected to account for the largest market share in global P2P lending market owing to the increasing adoption of P2P platforms. UK stands third after America and Asia Pacific and one of the most highly established markets of P2P in the world. Moreover, China has occupied the major share in the market in Asia Pacific due to the vast shadow banking sector and unofficial estimates that are endorsing the market. It has massive number of peer to peer lending platforms which counts around 2000 in numbers globally. China and US are the competitors of each other while Canada will be running high in growth in the upcoming years because of the advancements in SMEs and growing the startup businesses.

Peer to Peer (P2P) Lending Market Key Players:

• Upstart

• Funding Circle

• Prosper

• CircleBack Lending

• Peerform

• Lending Club

• Zopa

• Daric

• Pave

• Mintos

• Lendix

• RateSetter

• Canstar

• Faircent

• Other

This comprehensive report will provide:

• Enhance your strategic decision making

• Assist with your research, presentations and business plans

• Show which emerging market opportunities to focus on

• Increase your industry knowledge

• Keep you up-to-date with crucial market developments

• Allow you to develop informed growth strategies

• Build your technical insight

• Illustrate trends to exploit

• Strengthen your analysis of competitors

• Provide risk analysis, helping you avoid the pitfalls other companies could make

• Ultimately, help you to maximize profitability for your company.

Our Market Research Solution Provides You Answer to Below Mentioned Question:

• Which are the driving factors responsible for the growth of market?

• Which are the roadblock factors of this market?

• What are the new opportunities, by which market will grow in coming years?

• What are the trends of this market?

• Which are main factors responsible for new product launch?

• How big is the global & regional market in terms of revenue, sales and production?

• How far will the market grow in forecast period in terms of revenue, sales and production?

• Which region is dominating the global market and what are the market shares of each region in the overall market in 2017?

• How will each segment grow over the forecast period and how much revenue will these segment account for in 2025?

• Which region has more opportunities?

Interested in this report?

Get your sample now!

Table of Content

1. Chapter - Report Methodology

1.1. Research Process

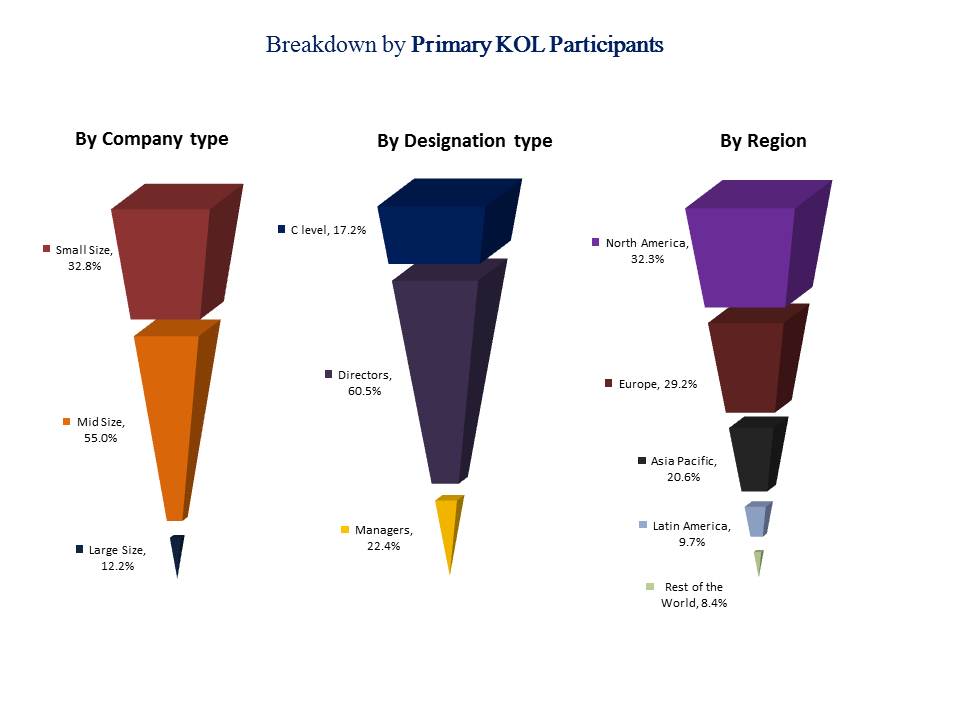

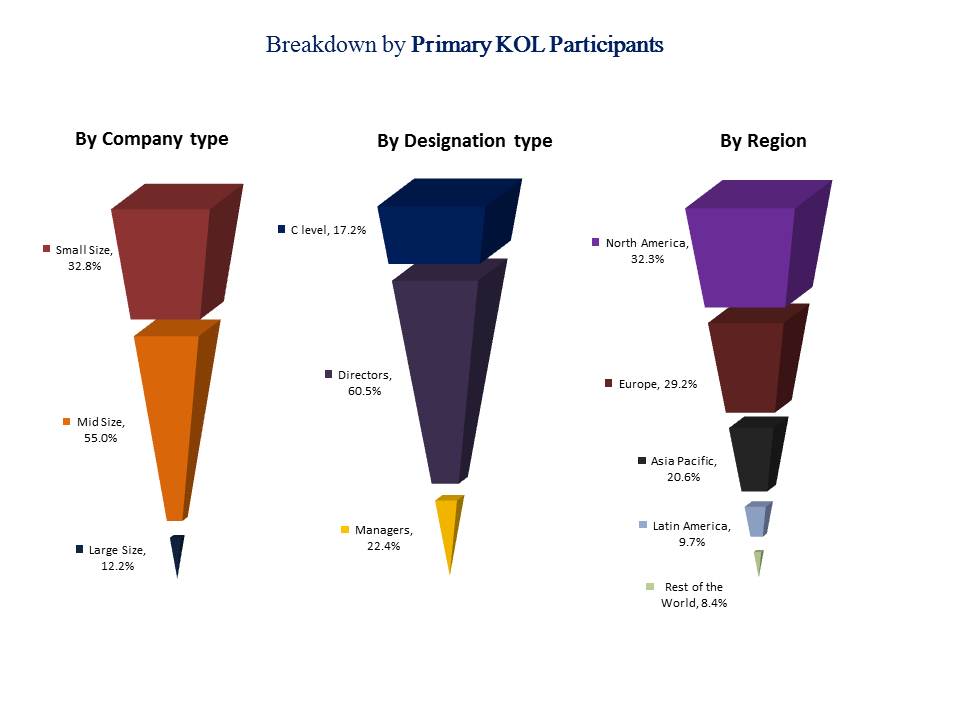

1.2. Primary Research

1.3. Secondary Research

1.4. Market Size Estimates

1.5. Data Triangulation

1.6. Forecast Model

1.7. USP’s of Report

1.8. Report Description

2. Chapter – Global Peer to Peer (P2P) Lending Market Overview: Qualitative Analysis

2.1. Market Introduction

2.2. Executive Summary

2.3. Global Peer to Peer (P2P) Lending Market Classification

2.4. Market Drivers

2.5. Market Restraints

2.6. Market Opportunity

2.7. Peer to Peer (P2P) Lending Market: Trends

2.8. Porter’s Five Forces Analysis

2.8.1. Bargaining Power of Suppliers

2.8.2. Bargaining Power of Consumers

2.8.3. Threat of New Entrants

2.8.4. Threat of Substitute Product and Services

2.8.5. Competitive Rivalry within the Industry

2.9. Market Attractiveness Analysis

2.9.1. Market Attractiveness Analysis by Segmentation

2.9.2. Market Attractiveness Analysis by Region

3. Chapter - Global Peer to Peer (P2P) Lending Market Overview: Quantitative Analysis

3.1. Global Peer to Peer (P2P) Lending Market Revenue (USD Million), Market Share (%) and Growth Rate (%), 2014- 2025

3.2. Global Peer to Peer (P2P) Lending Market Revenue Market Share (%), 2014- 2025

3.3. Global Peer to Peer (P2P) Lending Market Sales (Number of Units), Market Share (%) and Growth Rate (%), 2014- 2025

3.4. Global Peer to Peer (P2P) Lending Market Sales Market Share (%), 2014- 2025

4. Chapter – Global Peer to Peer (P2P) Lending Market Analysis: By Type

5. Chapter – Global Peer to Peer (P2P) Lending Market Analysis: By Applications

6. Chapter – Global Peer to Peer (P2P) Lending Market Analysis: By End-User

7. Chapter - Global Peer to Peer (P2P) Lending Market Analysis: By Manufacturer

7.1. Global Peer to Peer (P2P) Lending Market Revenue (USD Million), by Manufacturer, 2014 - 2025

7.2. Global Peer to Peer (P2P) Lending Market Share (%), by Manufacturer, 2018

7.3. Global Peer to Peer (P2P) Lending Market Sales (Number of Units), by Manufacturer, 2014 - 2025

7.4. Global Peer to Peer (P2P) Lending Market Share (%), by Manufacturer, 2018

7.5. Global Peer to Peer (P2P) Lending Market Price (USD/Unit), by Manufacturer, 2014 - 2025

7.6. Global Peer to Peer (P2P) Lending Market Revenue Growth Rate (%), by Manufacturer, 2014 – 2025

7.7. Merger & Acquisition

7.8. Collaborations and Partnership

7.9. New Product Launch

8. Chapter –Peer to Peer (P2P) Lending Market: Regional Analysis

8.1. North America

8.1.1. North America Peer to Peer (P2P) Lending Market Revenue (USD Million) and Growth Rate (%), 2014 – 2025.

8.1.2. North America Peer to Peer (P2P) Lending Market Revenue (USD Million) By Country, 2014 – 2025.

8.1.3. North America Peer to Peer (P2P) Lending Revenue Market Share (%) By Country, 2014 – 2025.

8.1.4. North America Peer to Peer (P2P) Lending Market Revenue (USD Million) and Growth Rate, By Market Segmentation, 2014 – 2025.

8.1.5. North America Peer to Peer (P2P) Lending Market Revenue (USD Million), Market Share (%) and Growth Rate, By Market Segmentation, 2014 – 2025.

8.1.6. North America Peer to Peer (P2P) Lending Market Sales (Number of Units) and Growth Rate (%), 2014 – 2025.

8.1.7. North America Peer to Peer (P2P) Lending Market Sales (Number of Units) By Country, 2014 – 2025.

8.1.8. North America Peer to Peer (P2P) Lending Sales Market Share (%) By Country, 2014 – 2025.

8.1.9. North America Peer to Peer (P2P) Lending Market Sales (Number of Units) and Growth Rate, By Market Segmentation, 2014 – 2025.

8.1.10. North America Peer to Peer (P2P) Lending Market Sales (Number of Units), Market Share (%) and Growth Rate, By Market Segmentation, 2014 – 2025.

8.2. Europe

8.3. Asia Pacific

8.4. Latin America

8.5. Middle East & Africa

9. Chapter - Company Profiles

9.1. Upstart

9.1.1. Financials

9.1.2. Product portfolio

9.1.3. Peer to Peer (P2P) Lending Market Revenue (USD Million) and Market Share (%), 2014 - 2018

9.1.4. Peer to Peer (P2P) Lending Sales Market Share (%), 2014 - 2018

9.1.5. Business strategy

9.1.6. Recent developments

9.2. Upstart

9.3. Funding Circle

9.4. Prosper

9.5. CircleBack Lending

9.6. Peerform

9.7. Lending Club

9.8. Zopa

9.9. Daric

9.10. Pave

9.11. Mintos

9.12. Lendix

9.13. RateSetter

9.14. Canstar

9.15. Faircent

9.16. Others

10. Chapter – Market Research and Findings